Purpose of the Allowance. For example, say a company lists 100 customers who purchase on credit and the total amount owed is $1,000,000. The $1,000,000 will be reported on the balance sheet as accounts receivable. The purpose of the allowance for doubtful accounts is to estimate how many customers out of the 100 will not pay the full amount

Allowance for Doubtful Accounts | Definition, Calculations, & Examples

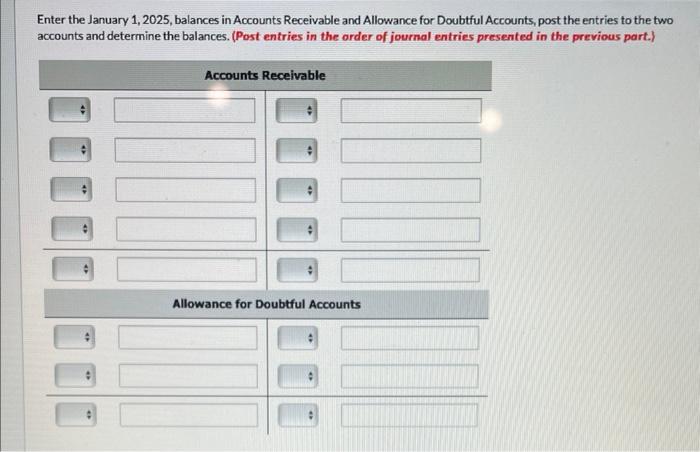

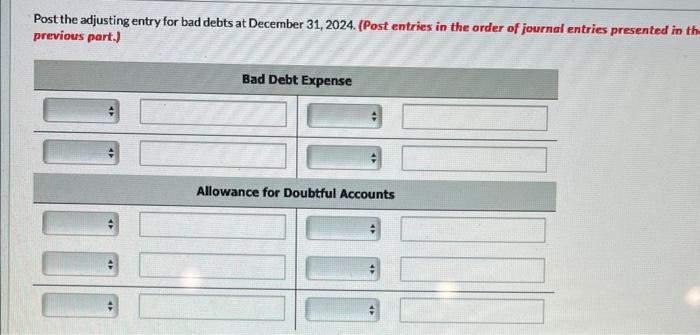

Nov 6, 2023High School answer answered On December 31,2024 , when its Allowance for Doubtful Accounts had a debit balance of $1,469, Cullumber Co. estimates that 11% of its accounts receivable balance of $77,700 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts.

:max_bytes(150000):strip_icc()/baddebt.asp_Final-e3319b0274574091a2dac2e4fb87f1c4.png)

Source Image: investopedia.com

Download Image

On December 31, 2024, when its Allowance for Doubtful Accounts had a debit balance of $1,403, Blossom Co estimates that 9% of its accounts receivable balance of $94,500 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts.

Source Image: financialfalconet.com

Download Image

Can someone see if you have viewed their Instagram page and how many times even if you don’t follow, like, or comment on their page? – Quora The following information is related to December 31, 2024 balances. • Accounts receivable • Allowance for doubtful accounts (credit) • Cash realizable value $1430000 (103000) 1327000 During 2025 sales on account were $390000 and collections on account were $217000. The company wrote off $21100 in uncollectible accounts.

Source Image: financialfalconet.com

Download Image

On December 31 2024 When Its Allowance For Doubtful Accounts

The following information is related to December 31, 2024 balances. • Accounts receivable • Allowance for doubtful accounts (credit) • Cash realizable value $1430000 (103000) 1327000 During 2025 sales on account were $390000 and collections on account were $217000. The company wrote off $21100 in uncollectible accounts. Bad debt expense for 2024 would be: Multiple Choice $6,598. $7,700. $7,398. None of these answer choices are correct. As of December 31, 2023, Gill Company reported accounts receivable of $223,000 and an allowance for uncollectible accounts of $8,500. During 2024, accounts receivable increased by $23,600 (that change includes $7,700 of bad

Types of Adjusting Entries with Examples – Financial Falconet

On December 31, 2016, when its Allowance for Doubtful Accounts had a debit balance of $1,369, Oriole Company estimates that 10% of its accounts receivable balance of $74,700 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts. Click the card to flip 👆 Allowance for Doubtful Accounts: Methods of Accounting for

Source Image: investopedia.com

Download Image

Solved At December 31,2024 , Oriole Imports reported this | Chegg.com On December 31, 2016, when its Allowance for Doubtful Accounts had a debit balance of $1,369, Oriole Company estimates that 10% of its accounts receivable balance of $74,700 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts. Click the card to flip 👆

Source Image: chegg.com

Download Image

Allowance for Doubtful Accounts | Definition, Calculations, & Examples Purpose of the Allowance. For example, say a company lists 100 customers who purchase on credit and the total amount owed is $1,000,000. The $1,000,000 will be reported on the balance sheet as accounts receivable. The purpose of the allowance for doubtful accounts is to estimate how many customers out of the 100 will not pay the full amount

Source Image: patriotsoftware.com

Download Image

Can someone see if you have viewed their Instagram page and how many times even if you don’t follow, like, or comment on their page? – Quora On December 31, 2024, when its Allowance for Doubtful Accounts had a debit balance of $1,403, Blossom Co estimates that 9% of its accounts receivable balance of $94,500 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts.

Source Image: quora.com

Download Image

BS1 | PDF | Partnership | Balance Sheet SOLVED: Texts: On December 31, 2024, when its Allowance for Doubtful Accounts had a debit balance of 1,403, Blossom Co. estimates that 9% of its accounts receivable balance of $94,500 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts.

Source Image: scribd.com

Download Image

Solved Presented below is an aging schedule for Blossom | Chegg.com The following information is related to December 31, 2024 balances. • Accounts receivable • Allowance for doubtful accounts (credit) • Cash realizable value $1430000 (103000) 1327000 During 2025 sales on account were $390000 and collections on account were $217000. The company wrote off $21100 in uncollectible accounts.

Source Image: chegg.com

Download Image

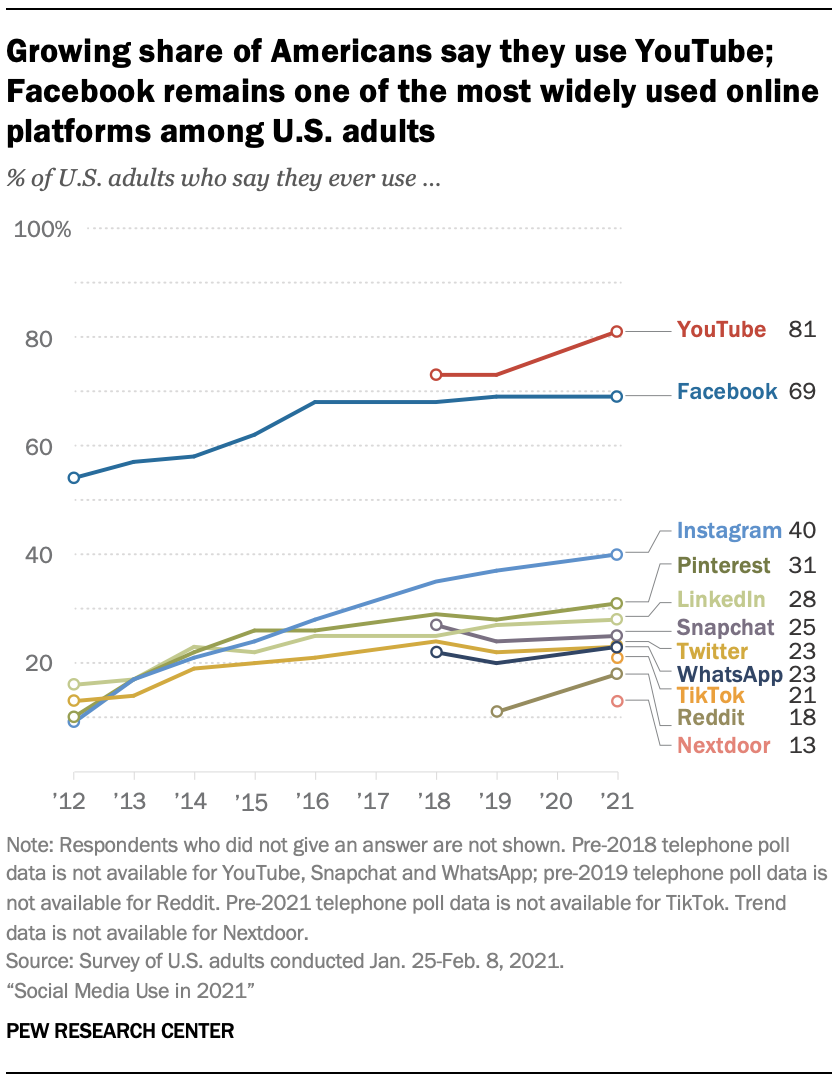

Social Media Use in 2021 | Pew Research Center Bad debt expense for 2024 would be: Multiple Choice $6,598. $7,700. $7,398. None of these answer choices are correct. As of December 31, 2023, Gill Company reported accounts receivable of $223,000 and an allowance for uncollectible accounts of $8,500. During 2024, accounts receivable increased by $23,600 (that change includes $7,700 of bad

Source Image: pewresearch.org

Download Image

Solved At December 31,2024 , Oriole Imports reported this | Chegg.com

Social Media Use in 2021 | Pew Research Center Nov 6, 2023High School answer answered On December 31,2024 , when its Allowance for Doubtful Accounts had a debit balance of $1,469, Cullumber Co. estimates that 11% of its accounts receivable balance of $77,700 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts.

Can someone see if you have viewed their Instagram page and how many times even if you don’t follow, like, or comment on their page? – Quora Solved Presented below is an aging schedule for Blossom | Chegg.com SOLVED: Texts: On December 31, 2024, when its Allowance for Doubtful Accounts had a debit balance of 1,403, Blossom Co. estimates that 9% of its accounts receivable balance of $94,500 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts.